Candidates: Are you interviewing and need support?

Top recruiting KPIs for 2020

Recruitment efficiency can vary depending upon your organization’s talent acquisition KPIs. In fact, many talent acquisition metrics exist. For instance, perhaps your performance as a recruiter is partly measured by a time to hire KPI. Talent acquisition metrics like these allow managers to assess a recruiting team’s strengths, as well as the recruitment efficiency of individual recruiters like you.

However, as a recruiter, you may be wondering which talent acquisition KPIs are most impactful. Have you considered which talent acquisition metrics will help you become a stronger recruiter and support business objectives?

Below we reveal the top recruiting KPIs that will directly advance your recruiting efficacy.

The most important recruiting coordinator KPIs and talent acquisition metrics every recruiter needs to master.

Talent acquisition KPIs

1. Time to hire

The time to hire KPI is one of the easier talent acquisition metrics to measure. Recruiters can determine time to hire by calculating the time between when a candidate enters an ATS to when they receive an offer. Time to hire calculations are crucial talent acquisition metrics that measure the efficiency of the recruiting process including applications, screenings, and interviews.

This calculation can reveal many systemic problems in your hiring process. For instance, recruiters may find that it takes weeks, or even months, to extend an offer. If that’s the case, consider how much time you spend screening and interviewing. Or, you could even weigh how long hiring managers take to make a decision.

Why It Matters

Depending on the industry, the average time to hire KPI can range from 14 to 63 days. (See individual industry’s time to fill in this eBook). A slow time to hire can harm an organization in several ways. Obviously, slow time to hire rates impact a company’s productivity and revenue. But what many recruiters don’t know is that bad time to hire rates also affect your company’s brand and, more importantly, the quality of your hires.

A slow time to hire could also impact hire quality. Your best candidates will drop out of an application process if they feel that it doesn’t respect their skills or time. This is also one of the best talent acquisition metrics because of how it can help you optimize your application process. For instance, if you notice that candidates begin an application but few finish it, consider what information you’re asking for, or how many steps are involved.

If candidates drop out halfway through your assessment, it may be time to review its length, accuracy, and redundancy. Hence, the time to hire KPI is one of the top recruiting KPIs to keep your eyes on—especially if you’re trying to increase recruitment efficiency.

While you’re busy initiating phone screens and scheduling interviews, your competition could be giving your ideal candidate(s) an offer.

2. Quality of hire

Quality of hire is one of the more unique talent acquisition metrics. And that’s because, depending on how you calculate it, quality of hire can reveal many insights about your recruiting process. For instance, many recruiting coordinator KPIs involve determining turnover rates, job performance, team fit, and employee retention and engagement. Many recruiters seek to optimize these specific numbers to hit their talent acquisition KPIs.

Recruiters should measure the quality of their hires through performance and retention data. You should also measure how your recruits fit with the company culture. If recruiters and hiring managers are pulling in what look like great hires who leave within the first six months, it’s possible that they’re screening for the wrong traits and aren’t surfacing the best candidates.

Why it matters

Measuring quality of hire can help recruiters determine and increase their performance. Quality of hire can also help recruiters determine where they find their best candidates. For instance, determine whether your best hires come from social media, online job boards, or word of mouth references. Determining the talent acquisition metrics can reveal what kinds of candidates become your strongest performers, and what screening methods surfaced them.

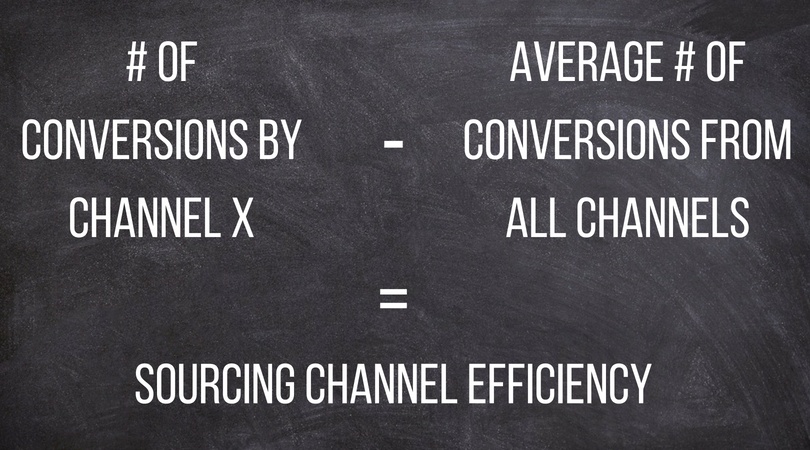

3. Sourcing channel efficiency

Do you ever wonder where all your job candidates come from? Sourcing Channel Efficiencies are talent acquisition metrics that tell you that information. For instance, you can determine if candidates came from college campuses, online job boards, or social media sources.

If you’re looking to increase your recruitment efficiency, start by optimizing source channels. You can get really specific to determine where candidates come from by using tools like Google Analytics or Facebook. You can also include surveys into your ATS and ask each candidate how they found your company.

If one of your recruiting coordinator KPIs is to increase quality hires, it’s easier to find out exactly where your candidates are entering the pipeline and focus more of your efforts directly there.

Why it matters

If one of your talent acquisition KPIs is to reduce turnover, it helps to know where your best candidates come from and understand what kinds of postings pique their interest. For instance, do they respond to videos that show off company culture? Or, do they look for articles about the important work the company does?

If more great candidates enter the pipeline through a social media site than a job board, review why job board postings aren’t attracting the right applicants. Tracking these sources gives insight into what candidates look for when they apply to your company. And it helps you as a recruiter to better position your employer brand.

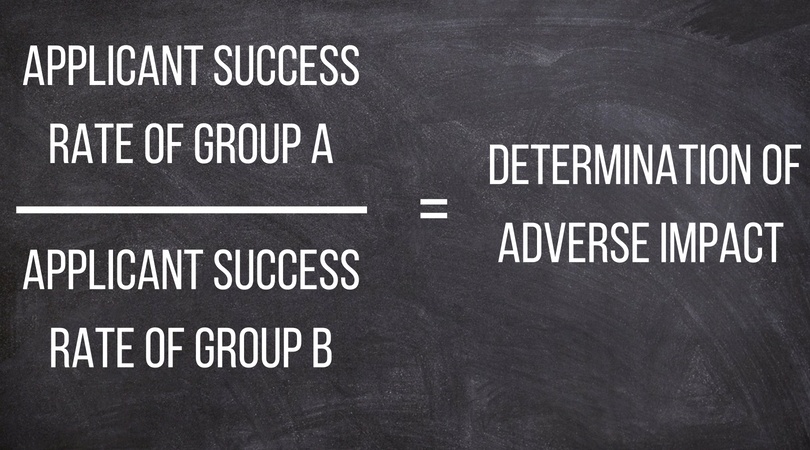

4. Adverse impact

Adverse impact is a negative consequence in the job screening process, affecting protected classes with bias. Perhaps one of the most crucial talent acquisition metrics, recruiters can evaluate for adverse impact with the “four-fifths rule.”

This rule states that bias exists within the hiring process if a protected class, such as women, are hired at a less than 80-percent (4/5ths) rate compared to the demographic with the highest selection rate. The ramifications of adverse impact are felt at every future step of the hiring process and will manifest a less diverse workforce across your organization.

When measuring for adverse impact, look beyond typical demographics you’d measure for compliance requirements in an AAP report, such as minority groups. When checking for adverse impact, consider all protected classes, such as workers over 40 or LBGTQ job candidates. You may not be mandated to track these classes, but doing so will provide a much better understanding of biases in your hiring process.

Why it matters

Workforce diversity has proven correlations with increased happiness and employee performance. It’s important for recruiters to make sure that the selection methods you use do not inadvertently screen out a protected group. If one of your top recruiting KPIs is to increase diversity, then calculating adverse impact is a must.

If you discover adverse impact, you need to audit your entire recruiting process to see what causes it. Ensure that your screening approaches aren’t accidentally biased. For instance, say you discover that only 25% of disabled applicants pass a screening. What can you do to solve this?

Double check where you’re sourcing candidates from; see if other recruitment channels help you find more diverse sources of talent. It may be as simple as not screening out candidates with employment gaps or as complex as sourcing from more diverse talent pools.

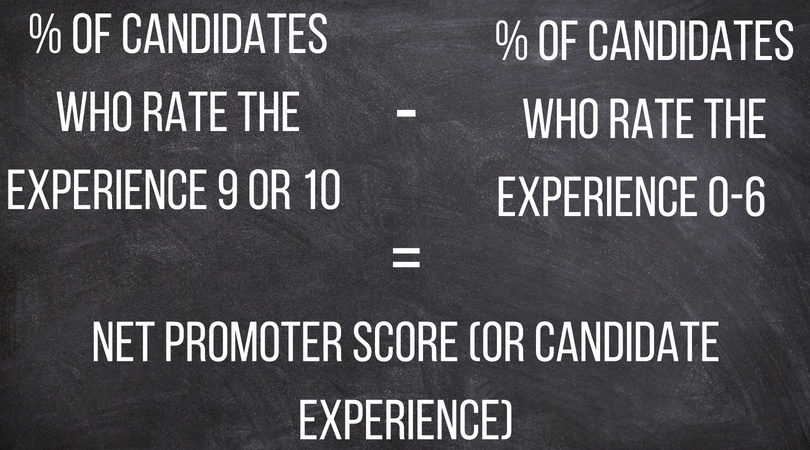

5. Candidate experience (Net Promoter Score)

The candidate experience encompasses the entire hiring process. It includes how candidates discover a position, develops interest, applies, interviews, and either receives an offer or a rejection. A poor candidate experience could decimate recruitment efficiency. For instance, if your candidate indicates a slow screening or application process, it can directly affect your company’s reputation.

Additionally, if candidates don’t feel they are able to accurately demonstrate their abilities, or an impersonal tone from the recruiting team, it can negatively impact their experience. Hence, candidate experiences are crucial talent acquisition metrics to get right.

Why it matters

The consequences of a poor candidate experience go beyond simply losing great candidates.

According to the Talent Board, 41% of candidates who gave their experience the lowest rating said they would take their business elsewhere.

These candidates also report being less likely to recommend positions to their own networks, narrowing your total pool of applicants.

Why does it matter for recruiters? Because your organization most likely tracks candidate experiences through surveys to gauge Net Promoter Score. Typically, it’s one of the most important talent acquisition KPIs and top recruiting KPIs. And it’s crucial that recruiters due their part to ensure an optimal NPS.

Companies with the highest NPS scores suggest implementing a survey after each step in the hiring process to maintain best practices. Assessing after each step not only creates a more holistic view of the candidate experience but helps identify specific bottlenecks in the recruiting process.

Wrap-up

Recruitment KPIs and talent acquisition KPIs are largely different for each recruiting role. Talent acquisition professionals can increase recruitment efficiency by calculating these crucial metrics.

Have you ever considered the ROI you can get from using video interviewing software?

Our new ROI calculator shows you the most immediate impacts that video interviewing can have for your recruiting efforts.